Use of Cookies - Cookies help us evaluate interaction with our website. By using our platform, you agree to our use of cookies. More

German companies are among the world’s leading tax avoiders

The Fresenius case: Health company avoids taxes just like Amazon and Google

Another bad day for McDonald’s, a good day for tax justice

Federal prosecutor in Brazil launches a criminal investigation into multinational's tax affairs, whilst European Parliament confirms the company will appear again in from of special tax committee.

Are you a tax super sleuth? Take the online quiz!

Are you a Tax Justice super sleuth or a Tax Justice novice? Take this online quiz to find out and share the result with your friends.....

Sign the Petition! Demand Tax Transparency

Public country-by-country reporting (CBCR) would make multinationals publish information showing where they make their money and if they are paying their taxes. Support accountability in corporate taxation.

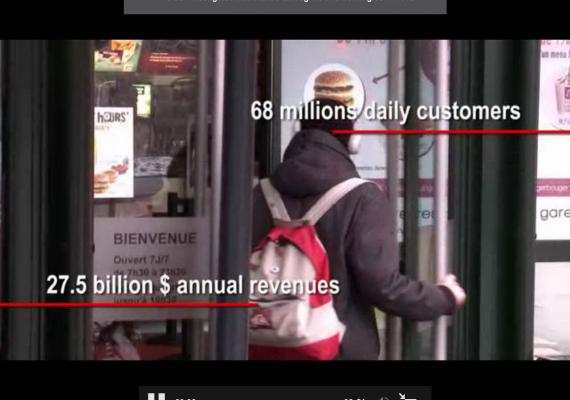

WATCH The EU investigates McDonald's tax regime and working conditions

McDonald's workers visited the European Parliament this month to talk to MEPs about the companies tax arrangements and working conditions. Watch the video from the Socialists and Democrats group.

McDonald’s is not just a tax dodger, but a bad employer: workers come to Brussels to demand action!

A bad week for McDonald's, as three petitions denouncing their working conditions are submitted to the European Parliament and Italian consumer associations launch antitrust complaint.

Will 2016 be the turning point for corporate tax avoidance?

With €1 trillion lost every year to tax dodgers, will 2016 finally be the year when big business and the wealthy are made to pay their fair share?

Tax Justice in Europe and Sub-Saharan Africa - Project Resources

Videos, leaflets, reports and much more produced as part of the Building Awareness of Tax Justice in Europe and Sub-Saharan Africa Project.

The Net Closes in on Tax Dodgers but There’s No Room for Complacency

European Parliament report is a big step forward, but the pressure must be maintained to get concrete measures to stop tax dodging.

Luxleaks : one year after, pressure is building up for corporate tax transparency

Piketty and MEPs join trade union leaders in writing to EU governments to demand public country-by-country reporting, whilst civil society makes voice heard in support of tax whistleblowers.

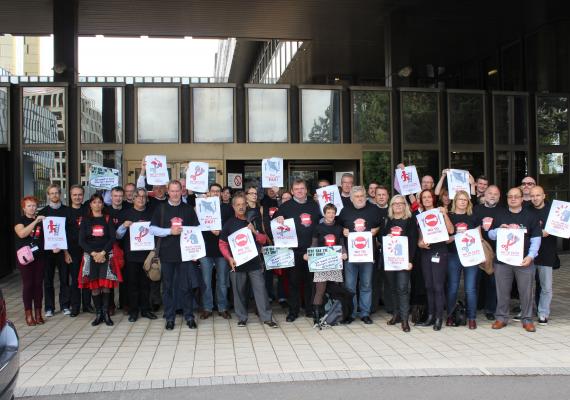

Building awareness of tax justice in Europe and Sub-Saharan Africa Report of Final Project Meeting

The final networking meeting of the EC-funded project by War on Want in cooperation with EPSU and affiliates from Sweden, the UK, Spain, Austria and Ireland took place in Brussels on 9 October. Over 30 participants from 8 countries shared their experiences of raising awareness of tax justice.

Building Awareness of Tax Justice - Vienna Meeting

Vienna meeting of EPSU-War on Want project 'Building awareness of tax justice and Millennium Development Goals in Europe and Sub-Saharan Africa'.

Update: Two weeks in the fight against the tax dodgers

From pressure on Commission President Juncker to blacklisting of uncooperative companies, the last couple of weeks have confirmed that the fight against tax avoidance is firmly at top of the political agenda.

Finance Ministers’ appearance before tax committee: who said what

The Special Committee on tax rulings and other similar measures (TAXE) met on 22nd September 2015 and had a first exchange of views with Pierre Gramenga, the Finance Minister of Luxembourg, on behalf of the Council, as LU holds the rotating presidency of the EU, and then with the Finance Ministers of Italy, France, Spain and Germany.

EPSU brings McDonald’s tax evasion menu in the French parliament

Last Friday, the European Federation of Public Services Unions presented McDonald’s tax avoidance scheme and EPSU's tax justice priorities at the Assemblée Nationale

EPSU supports Lima Declaration on Tax Justice and Human Rights

Tax revenue is the most important, reliable and sustainable instrument to resource human rights says a statement of an international coalition of tax justice groups including several with whom PSI and EPSU have collaborated

Commission's action plan on corporate taxation lacks clear actions

EPSU and ETUC joint press release

News bulletin #1

Tax justice campaign update: News from the front

Policy lunch at the European parliament

Organised by MEP Steinruck on working conditions in fastfood sector on 28 March 2015, Brussels

Building awareness of tax justice in Europe and sub-saharan Africa

First meeting in Madrid as part of the EC-funded project on tax justice led by EPSU and War On Want

Golden Dodges: McDonald’s $1.8 billion global tax avoidance strategy revealed

A new report Golden Dodges: How McDonald’s Avoids Paying its Fair Share of Tax, reveals that McDonald’s is using aggressive strategies to avoid paying tax in some of its largest markets.

EPSU brings McDonald’s tax evasion menu in the European parliament

Today, the European Federation of Public Services Unions has presented McDonald’s tax avoidance scheme and EPSU's tax justice priorities at third meeting of the European Parliament Special TAXE committee on tax rulings.

Greek union calls for more tax inspectors to fight tax evasion

The Greek public service trade union, ADEDY, notes a lack of tax inspectors in Greece compare to other European countries

UnHappyMeal report on McDonald’s tax avoidance strategy: First questions at the EP

Two MEPs from the S&D and GUE/NGL parliamentary groups express their concern about the McDonald’s aggressive tax planning and ask the European commission to present what it is going to be done to investigate the McDonald’s tax avoidance scheme presented in the UnHappyMeal report, co-published last February by EPSU.

EPSU’s NEA statement in support of Antoine Deltour, LuxLeaks tax source

Following their meeting of 17 March last, EPSU’s affiliated trade unions organising government and EU administration employees express their solidarity with Antoine Deltour who accomplished a moral duty in passing on to a journalist secret tax breaks rulings signed by the tax authorities of the Grand Duchy. The NEA committee calls for an EU-wide legal protection for whistleblowers.

UnhappyMeal: 1 milliard € en évitement fiscal au menu de McDonald’s

La structure fiscale de McDonald’s a permis d’éviter l’impôt sur une partie de ses recettes, coûtant aux pays européens plus d’1 milliard € entre 2009 et 2013.

Unhappy Meal: €1 Billion in Tax Avoidance on the Menu at McDonald's

Tax structure allowed McDonald’s to divert revenue for years, costing European countries over €1 billion in lost taxes between 2009 and 2013.

LuxLeaks reveal something is rotten at the heart of Europe

(Press communication, 19 November 2014) The Luxembourg tax leaks do not reveal anything new. EU governments and the Commission knew about corporate stratagems to pay as little tax as possible. What the International Consortium of Investigative Journalists (ICIJ) reveals is the industrial scale of the secret tax deals and the complicity of the Luxembourg government. As a result, billions of Euros have been lost at the expense of citizens who are subject to job, pay and welfare cuts.

Luxleaks enquiry blocked by largest EP groups: a missed opportunity

(Press release - Brussels 06 February) Yesterday, the leaders of the PPE, S&D, Liberals, opposed a plenary vote on the launch of a parliamentary enquiry committee on the #Luxleaks follow-ups. There was a sizeable group of MEPs that wanted this. There will now be a special committee that PPE and S&D had opposed earlier.

Contact Us

Send a Direct Message

Give Us a Call

- European Federation of Public Service Unions Rue Joseph II, 40 - Box 5 1000 Brusselsl

- 32 2 250 10 80 tel 32 2 250 10 99 fax

- Taxjustice@epsu.org